4 Key Insights on Taking Real Estate Assets On-chain

Tokenization of real-world assets is a multi-trillion-dollar opportunity for Web3

Dear Knights,

SBF finally got arrested. However, we are only yet to see the ripple effects of this FTX debacle and the ensuing chaos.

In a bear market like the one we are enduring, we either have to learn or build. In this issue, we’re going to be learning and it’s our guarantee. We are going to walk you through some insights on taking Real World Assets on-chain.

We’ve finished reading an 87-page report titled: “An Unreal Primer On Real World Assets”. And today’s headline article is all about a few key insights we found in that report. Let’s begin!!

Real Estate has been the biggest target so far in terms of tokenizing Real World Assets. But it’s not the only one. Some other assets that can be put on the blockchain are bonds, stocks, energy, certificates, etc. All these assets can be tokenized thanks to the immutable ledger and immutable code aka smart contracts.

👉 Urge you to read: Bull Case For On-chain Assets

Taking Real World Assets On-chain: 4 Key Insights

1. Two categories of RWAs

When it comes to tokenizing Real World Assets aka RWAs, there are two categories that emerge: Birth (creating new assets on the blockchain) & Rebirth (existing assets are put on a blockchain and tokenized).

DAO bonds, hashpower backed loans, agricultural perpetual loans, etc. all come under the birth category as they never existed in the real world. Blockchain makes their very existence possible.

Real Estate, collateral backed loans, etc. all existed in the real world. But with the help of blockchain and smart contracts, the web3 world is making its efforts to take it on-chain. The advantage of doing that is it improves liquidity, broadens access, lowers barriers to entry, and reduces information asymmetry.

This is the very same reason why Defi didn’t fail even during the FTX collapse. Even though the Defi world faced a lot of hacks this year and wasn’t able to offer a 10x better value proposition for all TradFi capital market participants, it will eventually do that.

2. We need a standard

Like how there is a standard to share files across the internet (PDF, JPEG, MP4, etc.) and how there is a standard to deploy smart contracts on Ethereum (ERC-20, ERC-721, etc), we need a standard for tokenizing the RWAs.

Why, you ask? The answer is pretty simply: doing so will reduce the transaction costs between buyers and sellers, driving market efficiency and price discovery. This establishes a common ground between all the participants.

Imagine that we create a token that doesn’t follow any token standard. Metamask would have to code for that, for them to support our token. And that’s not good for both of us which is why we have ERC token standards on Ethereum.

Establishing a standard that involves a legal and regulatory framework will take a very long time. And it’s a slow process. Which is why we have a shortcut to establishing consensus. Tokenization via Defi, where the underlying blockchain tech provides the consensus. Imagine all the labor and operational costs that Defi has saved us.

Yet, the problem remains: There is no clear standard for bringing RWAs on-chain.

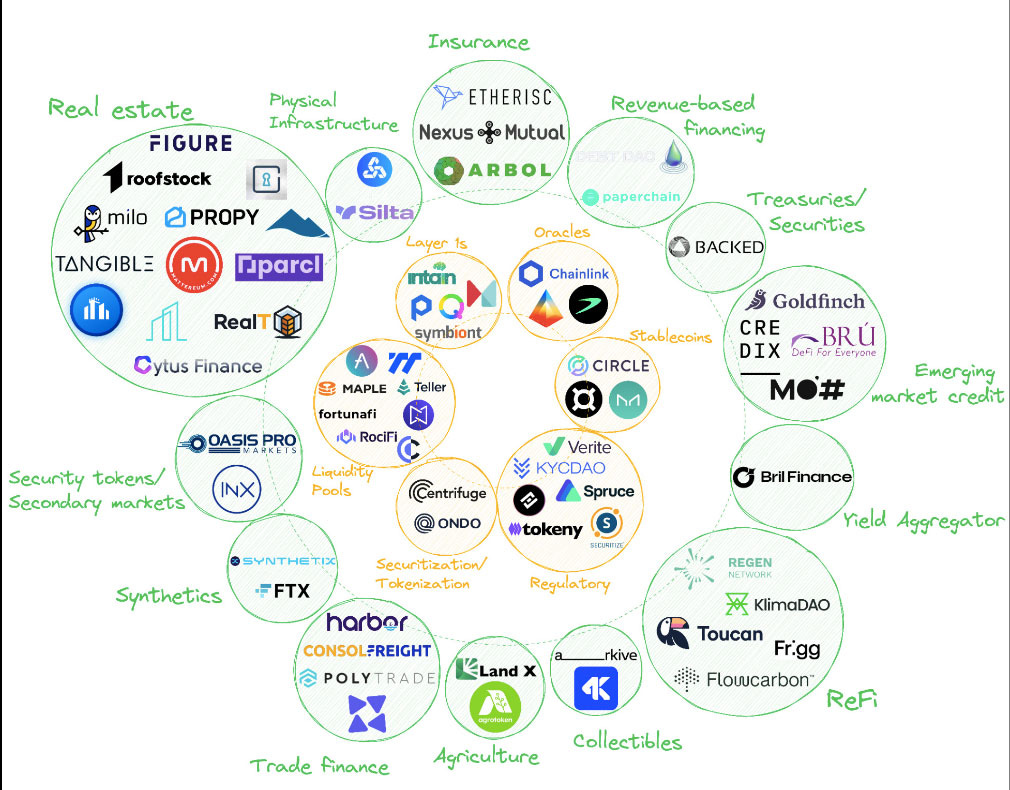

3. Infrastructuralists & Asset Specialists

Infrastructuralists are the ones that build platforms and facilitate the trading of RWAs. They enable the exchange, custody, and settlement of RWAs. Regulatory (Quadrata Network), Stablecoins (MakerDAO), Oracles (Chainlink), etc. come under this category.

And then there are Asset Specialists, the protocols that recognize the shortcoming of traditional finance and are trying to fix them. Real Estate (CitaDAO), Agriculture, ReFi, etc. come under this category.

Infrastructuralists enable asset specialists/applications in a manner similar to web2 Fintech’s Banking as a service.

Image:

Infrastructuralists (interior - orange)

Asset Specialists (exterior - green)

4. From TradFi to DeFi

First of all, we need to understand that the single most impactful product that can onboard the most marginal users to DeFi is ‘Birth’ assets (assets that won’t exist without blockchain).

The next thing we need to understand is the transition. In the early phases of cloud adoption, many companies maintained both server and serverless architectures. Eventually, they transitioned to AWS which became the standard for computing.

Now to switch to DeFi, they have to bear the cost of infrastructure providers (wallet, custodian, exchange, etc) and service providers (software, compliance, audits, etc).

On top of that, these institutions will have to bear the costs of both TradFi and DeFi for a medium-term period until they fully convert (or minimize) their customers (with better UX & infrastructure) & operations from TradFi to DeFi. In the long run, as DeFi grows, the operating costs will go down drastically.

And finally, the value accrues on both ends of the RWA value chain: Origination (sourced off-chain) and Liquidity (placed on-chain).

What does this model of value accrual predict? Asset originators will integrate by incubating liquidity protocols and then liquidity protocols will integrate by acquiring specialist originators and one another.

Comparing this model with CitaDAO, as we already have a liquidity protocol, our effort lies in bringing more Real Estate properties (RWAs) on-chain aka acquiring specialist originators.

Conclusion

Properties, securities, treasuries, commodities, energy, credit, etc. a lot of Real World Assets can be tokenized for the greater good. And a lot of emerging protocols are experimenting with tokenization.

At CitaDAO, we are pioneering Commercial Real Estate properties so that any individual can enter the space with very minimum capital.

🗓 Ecosystem Updates

Institutions To Tokenize $25B in Off-chain Assets in 2023, VanEck Execs Predict - Blockworks

House on a hill: Top countries to buy real estate with crypto (cointelegraph.com)

Contributor: Sujith

🧠 Great Reads

Contributor: Sujith

🤣 Memes of the week

Contributor: Ab_Colors