Downsides of Real Estate Tokenization

Dear Knights,

The future of Realfi as a class of investment is revolutionary and promising - high liquidity, easy access to everyone, composability, verifiable blockchain history, fractionalization, DeFi Tools and products, and many more. This is a nascent field and is undergoing experimentation and innovation as we build together. While all that is well and good, what about the downsides and problems that come with tokenizing real estate? Haven't you ever wondered? Our aim is to onboard you into this journey fully informed. So, today we will be exploring exactly that.

Note: This Article is an overview, and we will be digging deeper in the upcoming issues

Let us explore the new and unknown...

The Road to Real Estate Tokenization

Contributors (Writer, Editor): Fine, Cheetah

Tokenizing Real Estate and bringing the 200+ trillion-dollar asset class to DeFi will be more than fantastic, right? Yes it is, but it's easier said than done. To make this a reality we have a long way to go. Bringing a new system into life requires the transition and merging from the previous system and it takes time and work (and I mean REAL WORK). There are many roadblocks dear Knights, here are a few to begin with:

Security

Volatility

Legal Framework

Governance

Adoption

1. Security

RealFi basically is merging Real Estate and DeFi. In 2021 alone more than 2 billion dollars of crypto were stolen in DeFi hacks and exploits. DeFi is a young tech. A bug in a code, a security breach or a flash loan attack can wipe out your wallet and this can happen often if we don't take enough security measures. It is famously said in crypto circles “Not your keys, Not your Crypto'' which means that this comes with responsibility. If we lose our KNIGHT tokens or any other Real Estate tokens (RET) that's on us.

But hey, as DeFi technology matures and becomes more widely adopted, it is likely that the number of hacks and security breaches will decrease. This is because DeFi protocols and platforms will have had more time to identify and fix vulnerabilities, and users will have become more educated on how to securely manage their digital assets. In addition, the increased attention and scrutiny on DeFi will likely lead to the development of more robust security measures and best practices within the industry. As a result, the risk of losing one's digital assets due to security breaches or attacks will be substantially reduced, making DeFi a more reliable and trustworthy way to manage and invest in digital assets including RET.

2. Volatility

Crypto market is a rollercoaster where even stable coins die. The speculation in the market can pump a meme coin to the moon and make billionaires broke! even when invested in good projects. How fascinating, this unprecedented speculation and market condition could make the RET even 80% volatile a day. However, the reality is that only a little volume in the dump will not stop Investors from feeling insecure. A situation where there is liquidity but not with the traditional market rate.

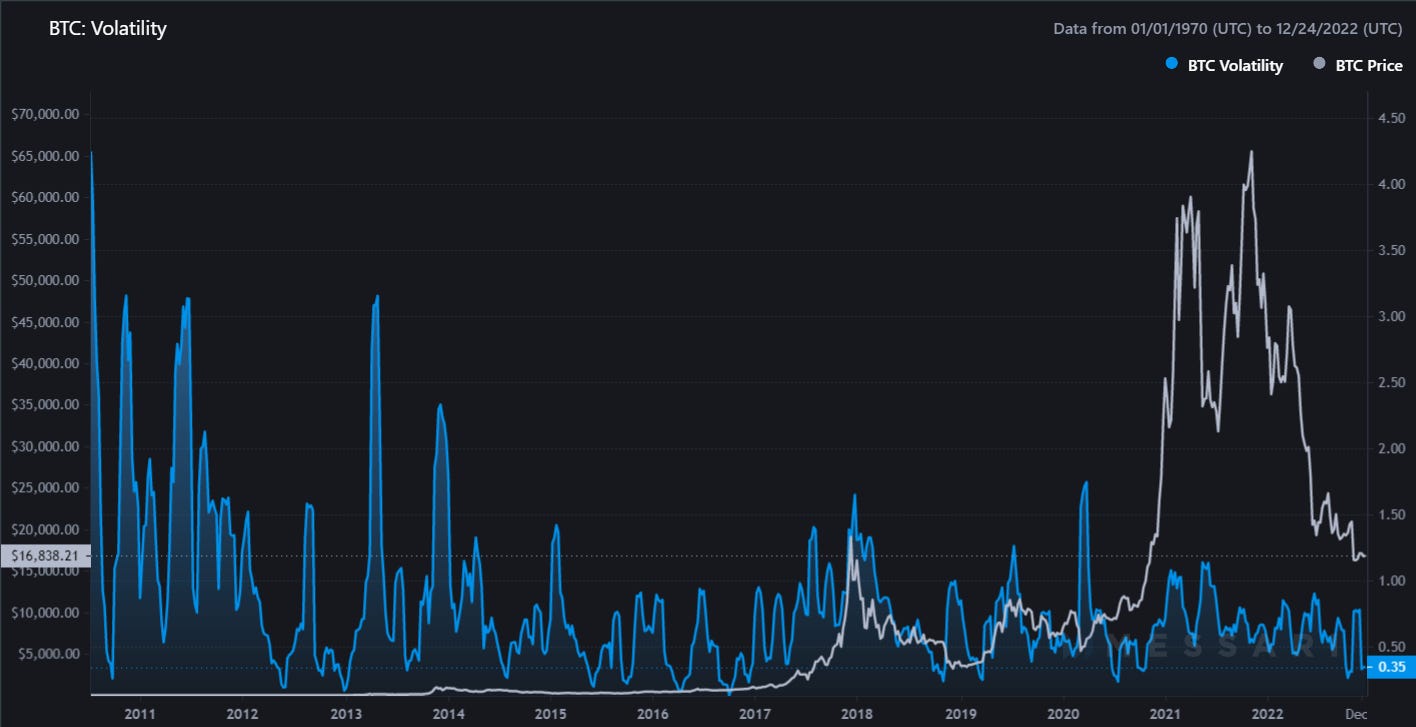

So how do we overcome this? The market will have to mature, and the market cap should become unshakable. It is a matter of time and adoption. Let's take bitcoin as an example:

The volatility of Bitcoin has significantly decreased as the market cap has grown. Increased adoption and a larger number of participants in the market tend to lead to more stable and predictable price movements. Those 100x in a day that were common in the early days of Bitcoin are long gone my fren :) When RET also reaches a high market cap and maturity, volatility won't be a significant concern.

3. Legal

The laws on digital assets, real estate and the degree of KYC requirements vary from state to state. Complying with every country's law requires a lot of regulatory formalities as RealFi is global and borderless like the internet. Why? Because:

what's compliant in the US may not be compliant with the EU region;

taxation laws and rates are not the same;

El Salvador welcomes Bitcoin and China Bans Bitcoin.

Note: RET are not ALWAYS Security Tokens

This is the general condition of laws across the globe. Tech is easy but dealing with the law is hard. Here is a likely scenario I am hoping and envisioning:

More people and businesses become aware of the benefits of RealFi and starts using it. Making RealFi more widespread and resulting in governments and regulatory bodies developing more concrete guidelines and frameworks. Introduction of new laws and regulations, as well as the clarification of existing ones. (I have my doubts on this)

4. Governance

Fractionalising real estate will give ownership to 1000s of market participants. Even when there are only 2 owners, a lack of consensus occurs. How to achieve consensus when there are 1000 opinions and each of them have equal shares? Who decides? and how to make sure that it will be the optimal decision? Governance is something the industry is actively experimenting and building - a new optimal governance framework that prevents bad actors from gaming the system while finding a solution for governance. This problem goes to the root of human existence and is a gamble of the system.

5. Adoption

“The internet is just a fad” …

Was it really? NO. Yet this is a cycle every Innovation will go through, from wheel to Bitcoin. The majority would always underestimate the potential in the early days and will criticize.

Tokenized real estate will be no different. This is a roadblock at a fundamental level.

At the industry level, most of the products have not yet reached product market fit. Listing a new property, buying a new property, using defi, dapps and tools, liquidity providing, AMM, self custody wallet, 1000s of crypto, on ramping and off ramping and many more things are just not comprehensive for an average person - why go through the complexity while they don't have to?

People calling each other using smartphones without knowing or caring how it works is the type of products and services Realfi needs to offer for mass adoption and cherishing the innovation and we will get there!

Closing Thoughts

RealFi is introducing a ton of value to the world that is worth exploring and building. Only time can show what RealFi is capable of. Even now at the early stage, the blockchain industry is worth (value) billions of dollars. RealFi is not doomed. Every innovation will face roadblocks. But as with every innovation, people who believe in it will work on it, make it a reality and will create fortune. Provide value to the world and the world will reward you. Fortune favors the brave! See you 10 years from now, hopefully as a patron of RealFi .

There is light at the end of the tunnel. We are down, but we are far from out.

🗓 Ecosystem Updates

Why 2023 Might Be a Big Year for Real World Asset (RWA) Tokenization

Goldman Sachs Continues Foray into Digital Assets with Tokenization Platform

Contributor: Sujith

🧠 Great Reads

Contributor: Sujith

🤣 Meme of the week

Contributor: AB_colours