FTX lent client funds to Alameda research using FTT as collateral. Alameda then used those funds for leveraged crypto speculation, and as the markets crashed, it couldn't pay back the funds. The rumors got out, and it led to a bank-run-style crash.

Can the year get any worse? Perhaps too soon to say!

FTX Collapse - Market Crash & Aftermath

Writer, Editor: EverythingBlockchain, Cheetah

This year saw billions wiping into thin air crushing retail and pushing crypto adoption far by years. Terra's collapse created a domino effect that brought down Celsius Network, Voyager, and 3 Arrows Capital. It was followed by regulatory authorities coming heavily with sanctions on Tornado Cash. The FTX debacle is our ghost of girlfriends past.

FTX was the world's 3rd largest crypto exchange. No one in their right mind would have expected it to crash the way it did, NO ONE.

For those who expected ETH to touch $10K and BTC $100K this year, we are far from solace, Knights. We didn't need such events to capitulate the prices further. Markets and prices aside, trust is at its lowest. Events like these have cascading effects for years to come. Adoption will slow down, and the noose will tighten.

SBF, Alameda Research and FTX

Crypto has produced many billionaires, and Sam Bankman-Fried (SBF) was one of them. Before the entire debacle, his net worth was over $16 billion making him one of the crypto poster boys.

SBF has time and again called for crypto regulation. He has been a proponent of regulating DeFi, actively participating and engaging with the politicians to build a regulatory landscape. From donations to political parties to lobbying for crypto, FTX and SBF donated more than $70 million to the political campaigns during the 2021/22 US election cycle.

Not too long ago, in October, he released a list of policy recommendations for regulators to consider bringing crypto under the regulatory ambit. One of the recommendations included the requirement of KYC/AML and licensing for DeFi. This lobbying was rather seen as a threat to DeFi and an attack on decentralized exchanges by industry experts and the overall community.

Alameda Research is the quant trading company that SBF built in 2017 at the age of 25. It earned a reputation for exceptional returns by employing quantitative trading strategies.

SBF launched FTX in 2019 with investors that include Sequoia Capital, Paradigm, and Ontario Teachers' Pension Plan. Interestingly, Binance was also one of the early investors in FTX.

FTT was the utility token of FTX and the focal point of FTX's rewards-based model. It is common for centralized exchanges to have their own tokens. It helps users save money in some form, either through rewards or fee discounts, etc.

There had been wide speculation on the relationship between the two entities even though Alameda was the first market maker for FTX giving it the liquidity to take it off the ground.

Binance

Binance last year unexpectedly pulled out its equity from FTX, which coincided with FTX closing a $900 million funding round at an $18 billion valuation. It had only been a couple of years and exiting when FTX was raising funds and valuation was rather uncanny.

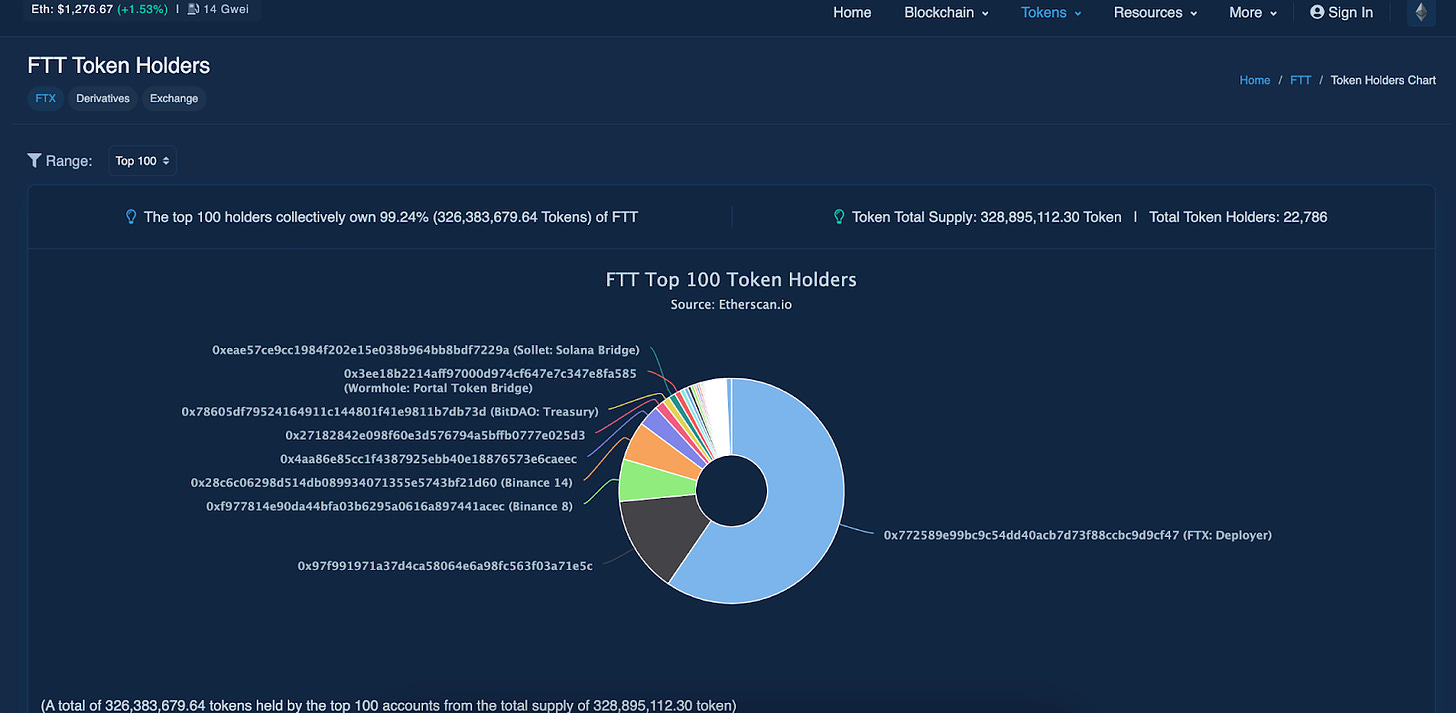

After the exit, Binance had control of a little under $600 million in FTX Token (FTT) received in exchange for equity. It was an enormous position in FTX Token, making it one of the top 100 accounts. The top 100 wallets controlled almost 99 percent of the FTT supply.

Build Up

Both Alameda and FTX were supposed to be independent entities. Instead, they were anything but that. What were supposed to be customer funds within an exchange were being secretly moved to Alameda.

It all started with a leaked balance sheet story about Alameda Research published by CoinDesk on 02 Nov, revealing a significant financial anomaly.

As it turns out, FTX was funneling funds to Alameda Research. The leaked balance sheets presented most of Alameda's holdings in FTT, and the article posed insolvency issues for FTX.

The entire net equity on Alameda's balance sheet was highly attributable to its FTT position. In the event of a downturn, any sharp drop in the FTT price could theoretically wipe out Alameda Research and have enormous implications for FTX. The cash flow of FTX, primarily composed of its own FTT tokens, raised the risk of insolvency. All it was waiting for was for a prick to bring it down.

The unfolding of the Story - The Prick

The narrative that FTX might be insolvent kept getting stronger. Finally, on 06 Nov, Binance's founder CZ (Changpeng Zhao) tweeted his intention to liquidate his FTT position.

Within no time, it started a bank-run-style crash resulting in both Alameda and FTX coming down. The price of the FTT token collapsed from $24 to less than $2.

SBF has since resigned as CEO of FTX and filed for bankruptcy. It happened in about three days and less than 280 characters on Twitter.

Sequence of Events

Even though both SBF and CZ have made fortunes from centralized exchanges, the underlying philosophies of both have been different.

Between CZ's tweet and the bankruptcy, a series of events happened.

Soon after the tweet, FTX announced having enough liquidity to buy out all client obligations, including Binance's FTT. Binance's CZ rejected an OTC deal (was it aimed at sinking FTT?). FTX users started withdrawing the funds, and there was massive sell pressure on FTT.

There were narratives, counter-narratives, deleted tweets, and false announcements aimed at controlling the fire that had already engulfed FTX and Alameda. But FTT was crashing, and nothing was going to change it.

The rumors were soon confirmed when Binance, on 08 Nov, through a letter of intent, announced to acquire FTX and bail out the company's obligations. It expected the absorption to cover the liquidity.

However, this also turned out to be short-lived, and a day later, Binance backed out after assessing FTX's financials. According to Bloomberg, the gap between liabilities and assets of the exchange was over $6 billion.

Had this deal gone through, Binance would have controlled more than 80 percent of the global crypto market.

Aftermath

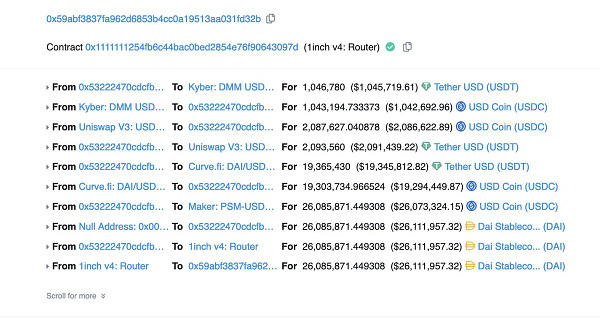

Even after billions of dollars had evaporated, this was far from over. After the bankruptcy, funds started moving from FTX to anonymous wallets. More than half a billion have already been transferred. While FTX claimed it to be a hack, others saw it as an insider job.

Reuters reported that FTX's legal and finance teams allegedly learned that SBF implemented a 'backdoor' in FTX's book-keeping system, built using bespoke software. As a result, nearly $1B of funds are additionally missing, possibly due to the backdoor implemented in secret.

If the latest rumors are to be believed, FTX was a front to divert the funds donated to Ukraine by the US back to the Democratic party.

Lessons

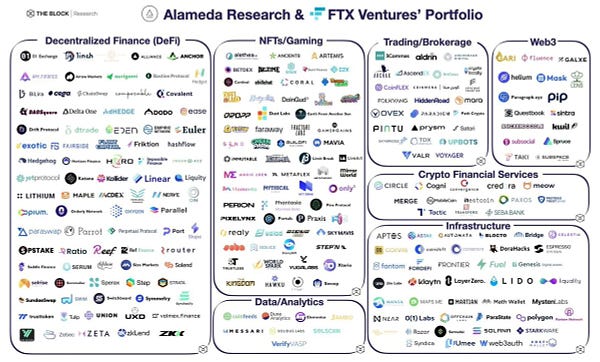

The fall of FTX brings many questions and lessons to the forefront, with one being a reminder of the close financial ties between centralized platforms, DeFi protocols, and Blockchains. The ownership and the circulation of the tokens by the broader ecosystem, including the competitors (Binance owning $530 million), DeFi protocols (BlockFi), and blockchain (Solana), can have far-reaching consequences for the entire ecosystem. There are a lot of lessons that can be drawn.

Retail takes the hit because VCs and experts have repeatedly failed to do their jobs. Institutional money is not always smart. Remember not to trust, but verify.

Crypto doesn't need a messiah or a savior, not one man to represent the entire space. We don't need an SBF, or a CZ, for it only makes it more centralized and dangerous. What we need is true decentralization. Nobody or no institution is too big to fall.

Transparency and overcollateralized systems that can deleverage without shattering the markets. Accordingly, exchanges should build user confidence by revealing their proof of reserves.

Remember the crypto truism "Not your keys, not your coins". Imbibe it, and do not leave your crypto on exchanges. Cryptocurrencies on FTX are long gone, and you wouldn’t want that to happen to you. Transfer your cryptocurrencies from centralized exchanges to hardware wallets and keep your private keys safe. Keep only a small amount for trading that you are comfortable losing.

Conclusion

SBF, FTX, and Alameda have caused irreparable damage and a significant setback to crypto. It has sent a shockwave throughout the contagion of all 134 Alameda firms and the entire crypto industry.

Trust is at an all-time low, and it will be long before people find it again. Crypto is not a Ponzi, even though players like SBF have played it like one. Unfortunately, some outside of the industry who like to project it as such have been handed a gift card.

Whether effective altruism (earn-to-give logic) or utilitarian raising (the point of view that life's purpose is to maximize others' well-being), it does not give anyone the right to pursue unfair means for any imagined greater good. We all have a choice to be responsible for ourselves and to others.

🗓 Ecosystem Updates

How FTX Collapsed: An Industry Insider's Take Ep 220 by The Blockcrunch

CEX Reserves by Nansen

Nansen Portfolio

Contributor: Ethan

🧠 Great Reads

Contributor(s): sujith_god

🤣 Memes of the week

Contributor: Nil