IRO Live Now! 17-26% APR Liquidity Pools*

Unlock new real-world property with CitaDAO. Let's Yield Farm RWA!

Singapore IRO Is Live Now!!

& More On New Liquidity Pools

Hello Knights,

We have some major updates for you…

Firstly, the long-awaited Singapore IRO is live now!

And the IRO will be active till 16th May 2023.

What does that mean? Well, the community can participate in the tokenization process by committing USDC (to receive Real Estate Tokens) till the IRO end date. And the total amount that needs to be committed is $635k for the IRO to be successful.

By the way, there is no cap on how much an individual should commit.

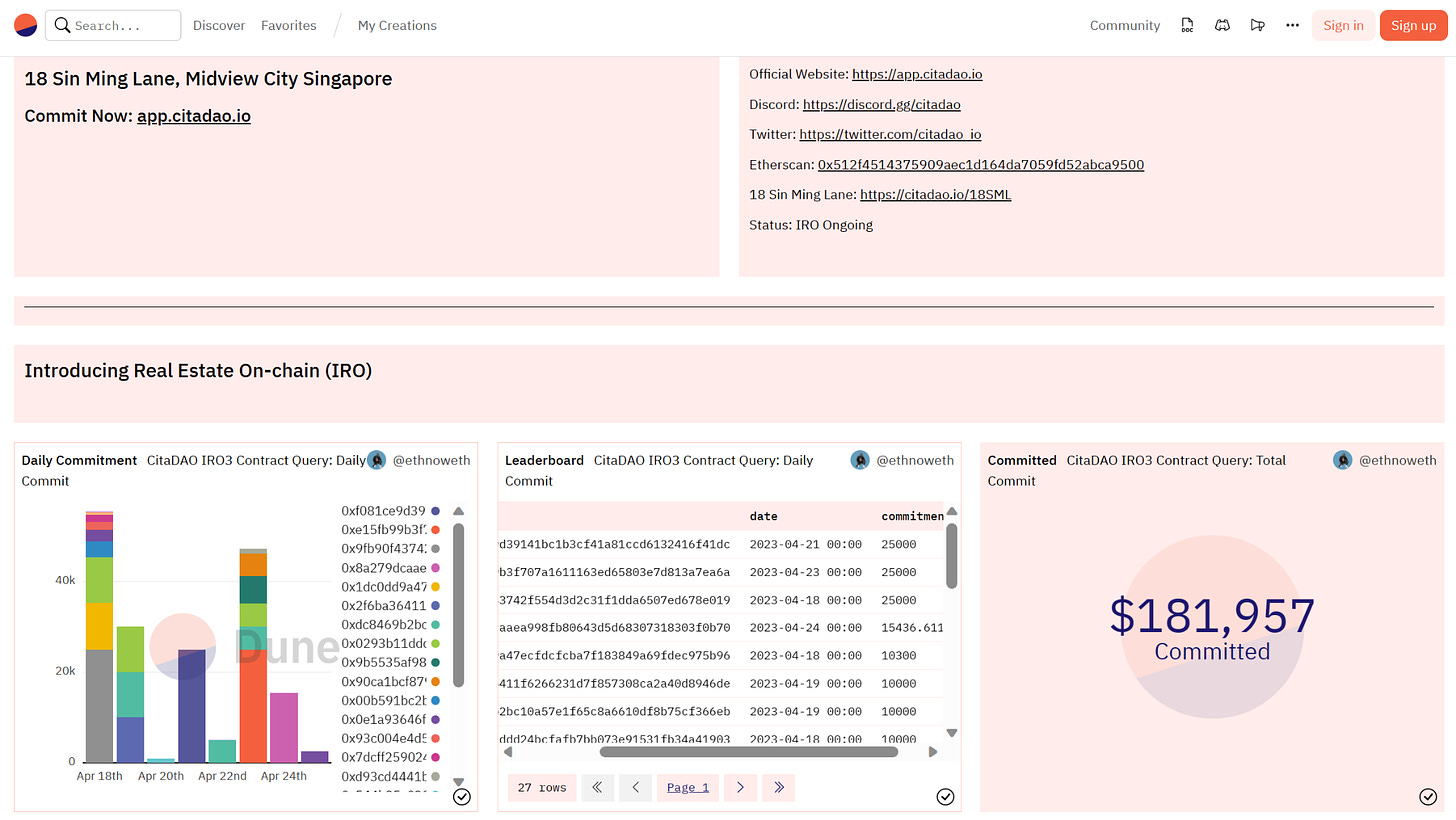

As of now, we have seen individual commitments from +$29 to even $25,000, totaling the amount to $181,957!

28.65% of goal in ~1 week!

71.38% more to go in next 3 weeks!What property are we trying to tokenize?

It is an industrial unit located in Midview City which is a mega, integrated business hub situated in the central part of Singapore.

The purchasing price is $635,000 (which is also why that’s the IRO amount too) with a floor area of 1,292 sq ft.

With a gross rental yield of 5.5% (the annual rent is $35,188) and amenities like supermarkets, schools, kindergartens, gyms, eateries, and shopping malls being very close to the area, we decided that this would be a great piece of real estate to tokenize.

The monthly rent, MCST, and property tax are as follows, respectively: $2,932.33, $357 per quarter (excluding GST), and $496 per quarter.

Still, need more info regarding the property? We recommend you go through this doc to get a full idea of the property and the area.

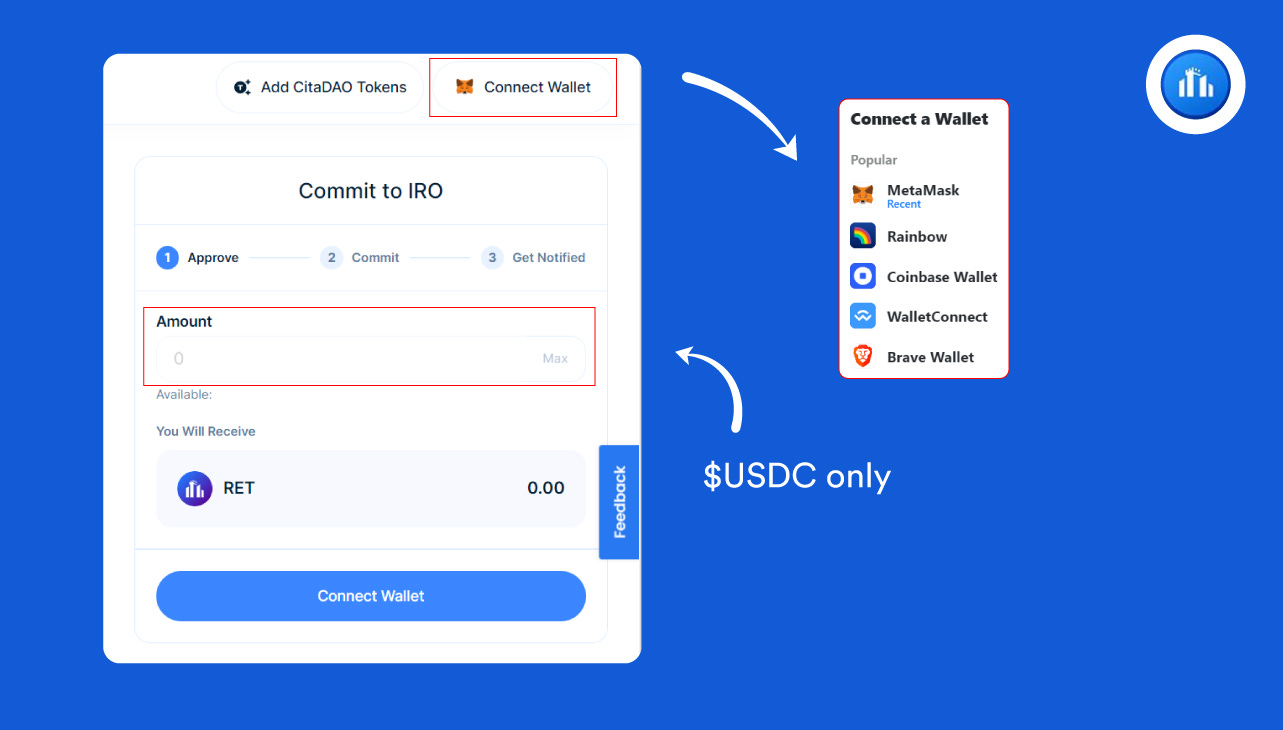

How to participate in the IRO?

Well, we made the process pretty simple and easy! All you need is a crypto wallet and some USDC in it (doesn’t matter how much).

Connect your wallet with CitaDAO and commit the amount that’d like to, here.

Then what?

Well, you wait for the IRO to succeed, and once that is done, you’d get back RETs aka Real Estate Tokens based on the amount you have committed.

Ok, but what if the IRO fails? Not to worry! You’d get back your USDC in full to your wallet.

We’ve got new pools for you!

Please note that if you are already a liquidity provider for our pools, we encourage you to migrate from the previous pools to the new ones.

Let’s take off your funds & deploy the assets here.

And these are the new pools that we are talking about.

With these pools, you'll enjoy enhanced features and more opportunities. If you have any questions or need assistance, don't hesitate to reach out to our support team.

That’s it for now! Looking forward to the IRO being successful! ✌️✌️✌️

🗓 Ecosystem Updates

Real-estate tokenization platform CoFund to tokenize $10M hotel in Bali

GORE German Office Real Estate AG enters into talks with BrickMark Group AG regarding a strategic investment in BrickMark Group and cooperation for the tokenization of real estate assets.

🧠 Great Reads

Asset Tokenization And Fractional Ownership: The Masses Will Invest In Everything

Tokenization of Real-World Assets a Key Driver of Digital Asset Adoption: Bank of America

🤣 Meme of the week

Contributors: Cheetah (Editor), Sujith (Leader) (Article, Ecosystem Updates, Great Reads, Infographic, Meme)

*Notes: 17-26% APR figures are those tallied at SGT 4PM on April 26, 2023. To check the current APR, please use the CitaDAO app. The APR may change depending on the pool ratio.