RWA Tokenization: $KNIGHT Token

Real World Asset (RWA) Tokenization Primed to Surge in 2023

Dear Knights!

Welcome to 2023, where not all is gloom and doom! We finally see some positive momentum as the crypto market trades in green.

Despite the nasty effects of the failure of FTX and other spectacular crashes of 2022, the instability seems to have resolved, at least temporarily. So, the need of the hour is to focus on the good and the future rather than dwell on the past.

And the good stems from the tech. Blockchain technology has gained immense traction owing to the overly publicized cryptocurrencies and DeFi, but its use case extends beyond finance. For example, blockchain-based tokenization democratizes access to previously unavailable investment asset classes. We’re heading toward a tokenized future, and black swan events like the FTX crash only reinforce the need for greater transparency and trustless systems.

Tokenization can be defined as the process of digitizing tangible/intangible assets into tradeable tokens that are stored on a blockchain. It includes traditional investments like stocks, bonds, and even real estate. Trade is not limited to tangible but also extends to intangible assets like digital art, intellectual property, etc. Tokenization is a promising application of blockchain technology with broad implications. It seeks to broaden market participation and provides users with security, immutability, and ease of trading. For a detailed understanding, read our issue on tokenization.

Tokenization has opened access to one of the most well-established asset classes - real estate. Blockchain has given a financial opportunity to all. The code in smart contracts allows real estate to be fractionalized into tradeable units. The setup enables investors to own fragments of a property (real estate tokens) and trade them like cryptocurrencies (BTC, ETH). Besides the financial barriers, illiquidity is another significant issue associated with investing in real estate. Real estate tokenization eliminates financial barriers (high capital-investment requirement, bureaucracy costs) and increases the liquidity of such a proven asset class.

Traditional finance offers individuals plenty of opportunities to invest in real estate without acquiring, owning, and managing properties. However, these opportunities come from REITs (Real Estate Investment Trusts), real estate crowdfunding/partnerships, fractional ownership, and real estate stocks. one of these stand a chance compared to real estate tokenization. Check out our article on REITS vs. RETS and Bull-case for on-chain assets to get all the details.

And the best part is that these assets have stood the test of time.

Take, for example, the KNIGHT token of CitaDAO.

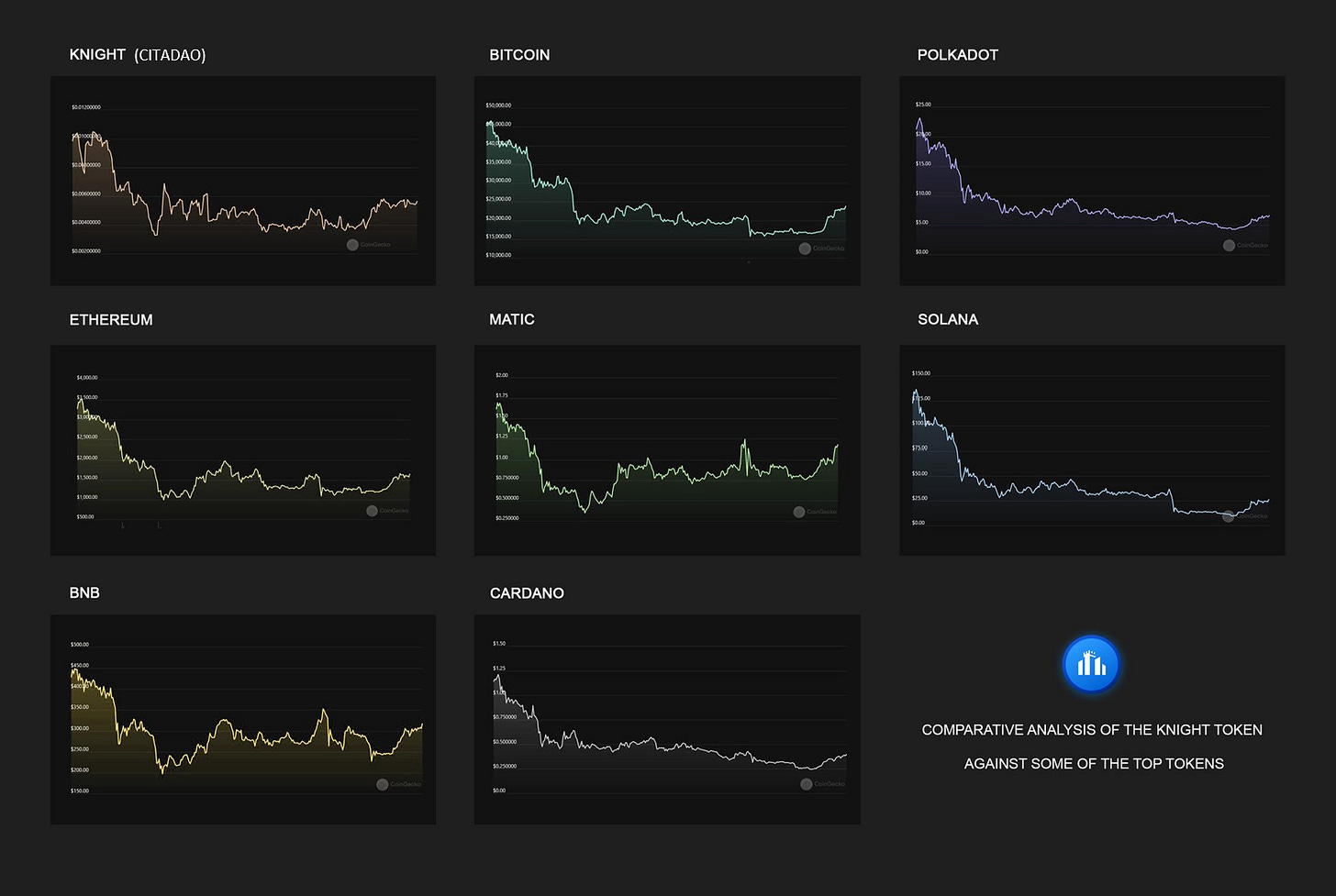

CitaDAO addresses the drawbacks of traditional real estate to deliver on its belief that Real Estate on-chain will transform DeFi and grow existing DeFi markets, such as collateralized loans, into a trillion-dollar TVL ecosystem. In addition, the team has devised a strategic plan to tackle the challenges investors face in tokenized real estate by emphasizing deep liquidity to sustain against swift price actions. A comparative analysis of the KNIGHT token during the last six months of the bear market against some of the top tokens (by MCAP) reveals the strong performance of this asset-backed class. While most of the tokens have suffered heavily on the count of Terra & FTX’s contagion, KNIGHT has maintained a steady price.

Let’s take a look at the charts.

We have used the price data from 01 Apr 22, a month before Terra’s collapse.

SOL has lost more than 80 percent of its value, from $122 to the current price of $24.

DOT’s price is down by about 70 percent from $21 to $6.

ADA has crashed from $1.14 to $0.37, losing more than 65 percent of its value.

MATIC has dropped from $1.6 to $0.95 & BNB from $430 to $300.

BTC is half of its price from $45000 to $23000, and ETH from $3300 to $1550.

Compare this data to the price of KNIGHT, which in the same time period has reduced from $0.0098 to $0.0055. Even though it also has lost around 40 percent, a closer look at the price chart of the KNIGHT token reveals that the price curve post-Terra implosion has been more or less steady. While most of the other coins crashed further with the FTX contagion, KNIGHT has maintained a steady price.

Poised to create a new asset class that isn’t tricked and manipulated by the market players, KNIGHT maintained a steady price even during bearish times.

More information about KNIGHT token can be found here.

Contributors (Writer, Editor): EverythingBlockchain, Cheetah

🗓 Ecosystem Updates

Contributor: Sujith

🧠 Great Reads

Contributor: Sujith

🤣 Meme of the week

Contributor: AB_colours