Dear Knights 🏰,

We are back with another interesting edition on RealFi. In this issue we covered IRO, the crowding funding mechanism we use to take properties on-chain. Hope it’ll be worth your time.

Contributors: EverythingBlockchain, Cheetah, AB_Colours, sujith_god

Thanks for reading Real World Asset in DeFi by CitaDAO! Subscribe for free to receive new posts and support our work.

This is the official newsletter of CitaDAO. To unsubscribe, please edit your settings on substack.

What is an IRO? How (& why) to participate in one?

At CitaDAO, we creating a process known as an IRO (Introducing Real Estate On-chain). It is the process through which any particular Real Estate property is tokenized and distributed to participants.

But, what is it in layman's terms? How to participate in it? Why should any Real Estate investor consider participating in it in the first place?

You already know what CitaDAO is….

We are building a very liquid real estate marketplace where anyone with just a dollar in their wallet can buy or sell real estate (tokens). We are basically taking Real Estate on-chain (putting it on the blockchain) and tokenizing it.

But for an individual to buy RET (Real Estate Tokens) for a particular property as a better hedge against inflation, that property has to be listed on-chain, and then have to be tokenized.

And IRO is the process for that to happen.

It all starts with the landlord's idea to list his property on-chain. Due Diligence will be conducted to check the legitimacy of the property and his ability to sell the property. It is only after professional conveyancing lawyers conduct due diligence, the IRO process starts (assuming everything is legit and legal).

Now, the tokenizing process will start. Users who are interested in that property will participate in the IRO and commit funds (stablecoins - USDC).

Every IRO is envisioned with a target amount ahead of time. For the IRO to be successful and for participants to receive the RETs based on the amount they committed, the target amount set initially has to be reached during the IRO time period (generally a few days). If not, the IRO fails and participants will get back their funds.

If the IRO succeeds, the participants will get RETs (and sometimes with some rewards). And those tokens can be traded on a decentralized exchanges like Uniswap. Token holders can sell them or buy more, making real estate assets more liquid.

Currently, we have pioneered two IROs. The Cardiff Commercial Building IRO which failed as the soft cap set wasn’t met. And the other one is Singapore Industrial Building IRO which was successful and now the RET of that property is a token titled ‘20SML0253SG’.

Check out the trades for that token here.

But what can a token holder do with these tokens, other than just HODLing?

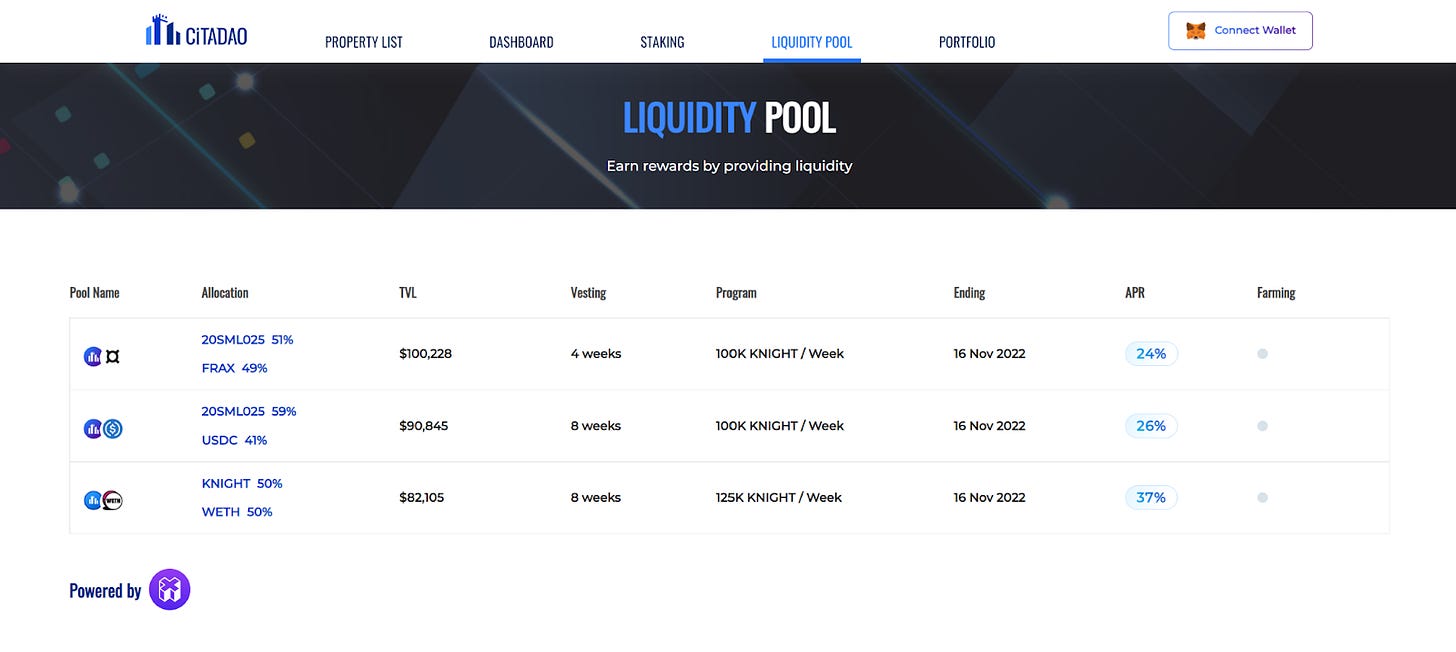

Well well, that’s when DeFi comes in. With those tokens (let’s say you have a few 20SML0253SG tokens) you can participate in a DeFi pool and provide liquidity to earn some yield on that. That yield comes in KNIGHT tokens, which is the governance token of CitaDAO.

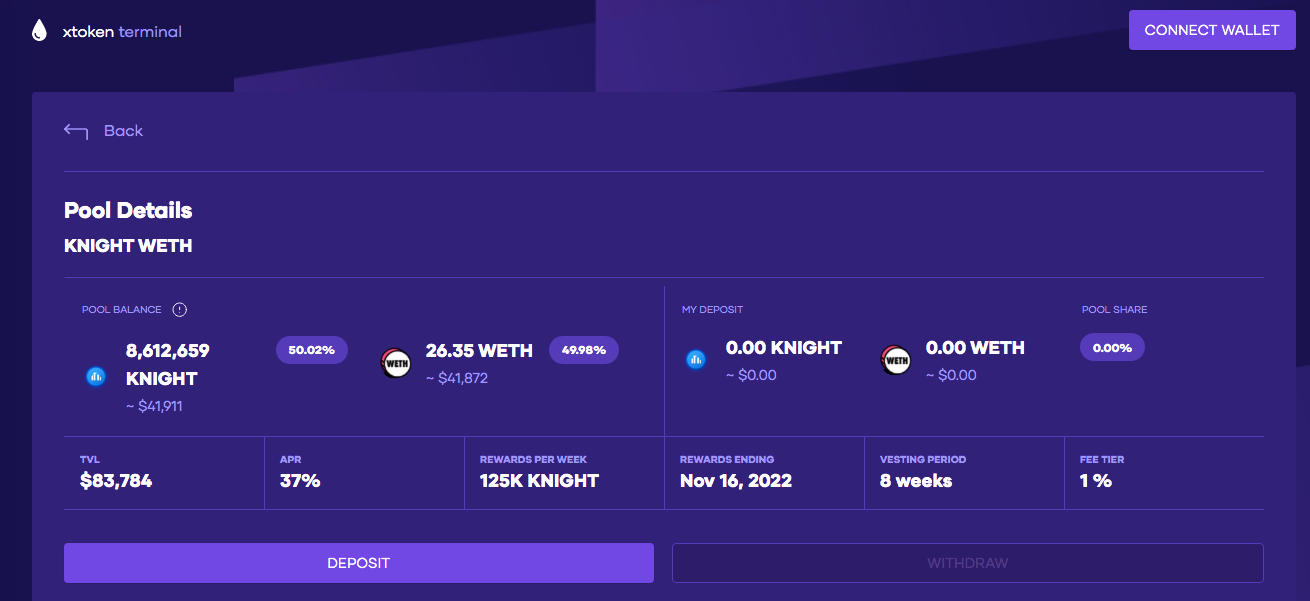

And moreover, you can use those earned KNIGHT tokens, to earn a yield on that too via xtoken terminal pool by adding WETH. Isn’t it just a pot of fortune?

And there are more pools to participate in!

Finally, with CitaDAO’s RETs:

You can buy or trade real estate tokens without any hassle and with a very minimum capital.

You can use DeFi pools to earn yield on top of the tokens you own.

You can use KNIGHT tokens to earn yield.

Real Estate is more liquid and more efficient with CitaDAO. CitaDAO is the path of real estate future. Join us in this journey. Follow us on Discord for future IRO announcements.

🗓 Ecosystem Updates

In case you missed it, there’s a civil war unfolding in Crypto Twitter right now. Almost like Avengers Civil War except instead of Captain America vs Iron Man, it’s now led by CZ/Binance and SBF/FTX. You can read more here

Ethereum used for cancer research

Circle Earns In-Principle Regulatory Approval in Singapore

🧠 Great Reads

October number in summary, Lars0x